When businesses suffer catastrophic blows to their cashflow, as many are experiencing now, it is important to explore every opportunity there is to raise cash.

Claiming capital allowances provides such an opportunity.

Amending Tax Returns to Claim Historic Expenditure and Reduce Tax Payable Now

Reducing tax bills is an easy way to retain cash and it is vitally important now to maximise the relief available through capital allowances and minimise the tax paid to HMRC.

Providing the assets are still owned, it is worth reviewing all expenditure incurred to see if additional allowances can be claimed.

Worked Example 1 – Income Tax Payer @ 45% Tax

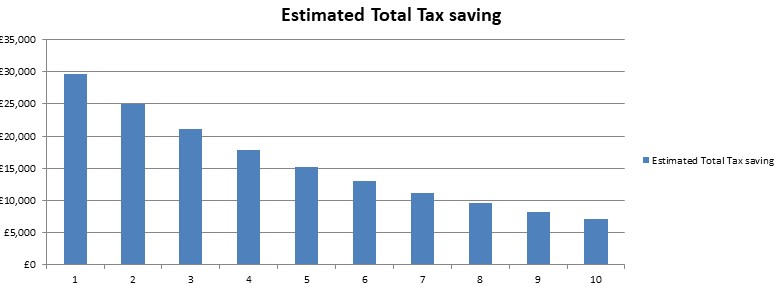

Take for example a dentist paying income tax at 45%. He carried out a refurbishment of his dental practice in 2015 and incurred £500k on assets qualifying for plant and machinery allowances. He never made a claim. As he still owns the assets, he is entitled to make a claim in a tax return that is still open. His total tax saved over time will equate to £225k (£500k x 45%). The graph below shows how the tax saving is achieved over 10 years. By amending a prior year tax return he will be able to obtain a tax rebate from HMRC equal to the allowances claimed in that period and going forwards he will be able to reduce the tax he pays to HMRC.

Example 2 – Corporation Taxpayer @ 19%

By contrast, a high street retailed spent £1m fitting out their store on a combination of fixtures and fittings and lighting but has never claimed. By not claiming, they are mssing out on total tax saving of £190k (£1m x 19%) over time. As they still own the assets, they can amend an open tax return and this will reduce their tax paid by £25k in the first year, as the graph below shows, thereby retaining more cash in the business.

If you have any queries in relation to how to maximise this relief and reduce your tax bill, Lovell Consulting can help.

Tax Credits – Enhanced Capital Allowances (ECAs)

ECAs are available on energy efficient assets that meet either a performance criteria or are makes and models approved by The Carbon Trust. Relief is given at 100% in the first year.

Where claiming ECAs results in an increased loss, a company may elect for the 100% deduction to be surrendered for a first-year tax credit payment. The tax credit payment will equate to 19% of the amount spent on ECA eligible equipment.

Example – High Street Retailer Installing ECA qualifying Lights

For a high street retailer who incurs £1m replacing lights with energy efficient ones that qualify for ECAs, if they are loss making they can surrender the 100% tax relief and instead claim a tax credit from HMRC for £190k (£1m x 19%). This is cash back from HMRC.

Please note, the first-year tax credit payment is capped to the greater of the company’s PAYE and NICs liabilities for the relevant chargeable period or £250k. The ECA credit is only available to incorporated companies. ECAs are also withdrawn from April 2020. Lovell Consulting can help.

Tax Credits – Land Remediation / Derelict Land Tax Relief

Land remediation relief (LRR) can provide tax relief in all commercial property sectors where companies are subject to corporation tax and is available to property investors (150%) and developers (50%) alike.

If a UK company makes a loss for an accounting period in which it incurs expenditure on remediating contaminated or derelict land, it may elect to receive a payable credit from HMRC. The amount of tax credit which can be claimed is 16% of the qualifying LRR for the accounting period the claim relates to. For both investors and developers, the cash return is equivalent to 24% of the expenditure incurred (16% x 150%). Lovell Consulting can help.

In addition to the benefits available above, HMRC have also recently confirmed they are deferring VAT quarterly payments.

In these uncertain times, it makes business sense to retain as much cash in the business as possible.

It has never been more important to seek professional advice. For expert advice, please contact jlovell@lovellconsulting.com